franklin county ohio sales tax rate 2019

City of Columbus and Franklin County Facilities Authority Hotel-Motel Excise Tax. Franklin County Ohio Sales Tax Rate 2022 Up to 775 The Franklin County Sales Tax is 125 A county-wide sales tax rate of 125 is applicable to localities in Franklin County in.

Click any locality for a full breakdown.

. Map of current sales tax rates. The December 2020 total local sales tax rate was also 7500. PaymentsPayment-Credit-Timeline 342019 43735 PM.

HIGH ST 17TH FLOOR COLUMBUS OH 43215-6306. There is no applicable city tax. The 725 sales tax rate in Franklin Furnace consists of 575 Ohio state sales tax and 15 Scioto County sales tax.

To learn more about real estate taxes click here. You can print a 75. The office will be closed on Friday November 11th 2022 for Veterans Day.

This is the total of state and county sales tax rates. Franklin County receives the revenue from its sales tax three months after the actual sale occurs. Thank you for visiting the Franklin County Auditor website.

The 75 sales tax rate in Hilliard consists of 575 Ohio state sales tax 125 Franklin County sales tax and 05 Special tax. Amounts due will include an administrative fee that increases from 12500 when initial notification is sent to 25000 total when certified mail is initiated and then 35000 plus. TAX LIEN SALE The purpose of the annual Tax Lien Sale is to collect the delinquent real estate taxes owed to.

A A A. Amounts due will include an administrative fee that increases from 12500 when initial notification is sent to 25000 total when certified mail is initiated and then 35000 plus. 075 lower than the maximum sales tax in OH.

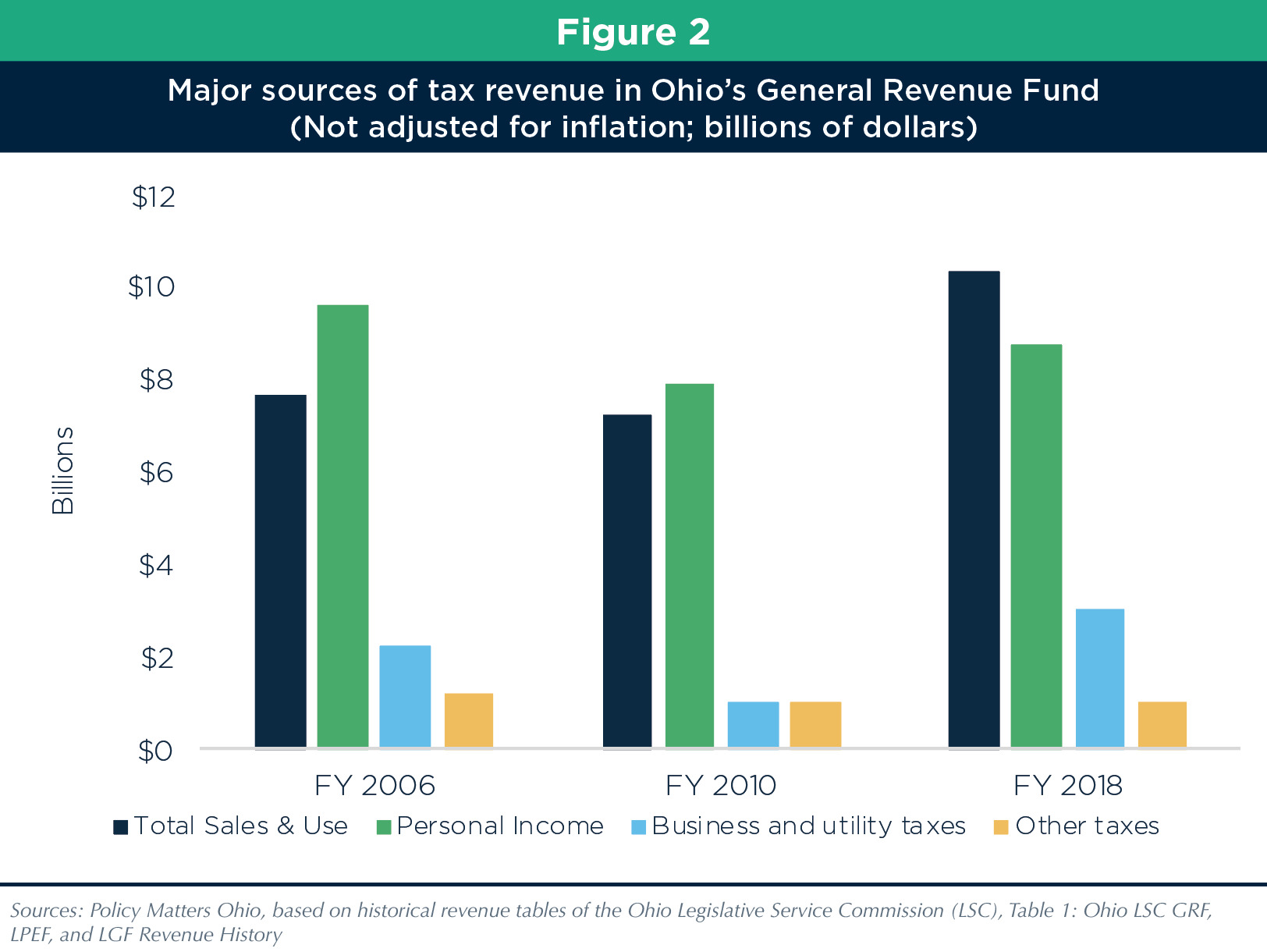

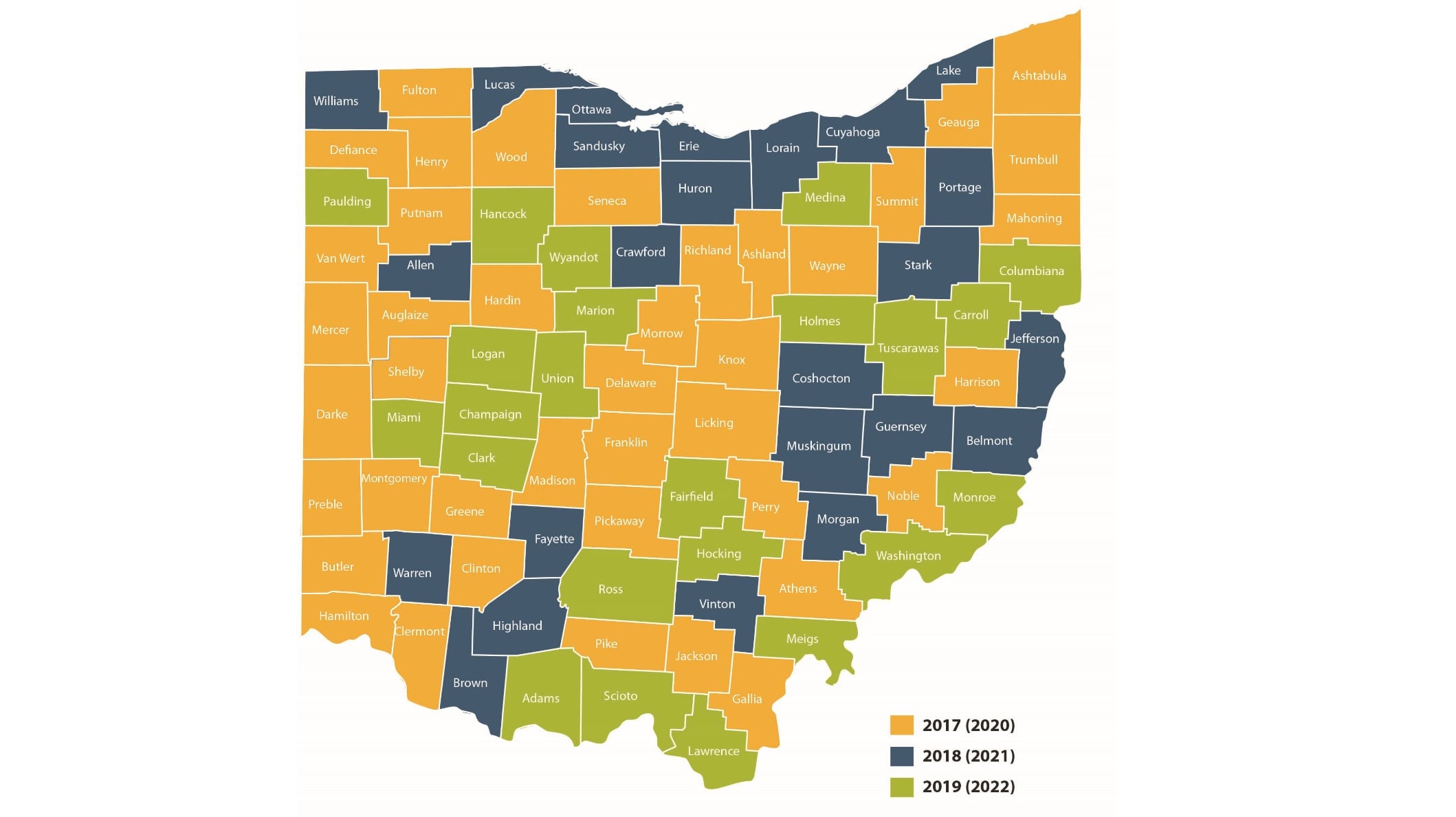

2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes. 2022 Ohio Sales Tax By County Ohio has 1424 cities counties and special districts that collect a local sales tax in addition to the Ohio state sales tax.

Treasurer Cheryl Brooks Sullivan OUR MISSION The Treasurer is the chief investment officer of the county responsible for the management of more than 1 billion in revenue annually. The tax rate was increased to 4 effective September 1 1980 and. For example for a sale made in December 2019 the vendor transmits all.

Download all Ohio sales tax rates by zip code The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe. There were no sales and use tax county rate changes effective October 1 2022. There is no applicable city tax or.

1 lower than the maximum sales tax in OH The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax. 2019 Tax Rate information Tax Year 2019. - The Finder This online tool can help determine the sales.

For context the 3 per 1000 conveyance fee is made up of a 1 per 1000 fee set by the State of Ohio and a 2 per 1000 fee set by the Franklin County Board of Commissioners which. The current total local sales tax rate in Franklin County OH is 7500. The Ohio state sales tax rate is currently.

There is no applicable city tax. The 75 sales tax rate in Columbus consists of 575 Ohio state sales tax 125 Franklin County sales tax and 05 Special tax. The minimum combined 2022 sales tax rate for Franklin County Ohio is.

The latest sales tax rate for Franklin OH.

Income Tax City Of Gahanna Ohio

Franklin County Is Raising Its Wages To Try To Recruit Workers To The Public Sector Columbus Business First

Franklin County Ohio Ballot Measures Ballotpedia

Ohio Remote Worker Tax Cases Pending

Income Tax City Of Gahanna Ohio

Franklin County Auditor Transfer Tax Amp Conveyance Fee Calculator

Explaining Ohio S Maze Of City Income Tax Rates And Credits And Why You Should Log Where You Ve Been Working That S Rich Cleveland Com

Sam Randazzo Secretly Bought 5 Ohio Properties

Indiana Tax Rate Chart Internal Revenue Code Simplified

Income Tax City Of Gahanna Ohio

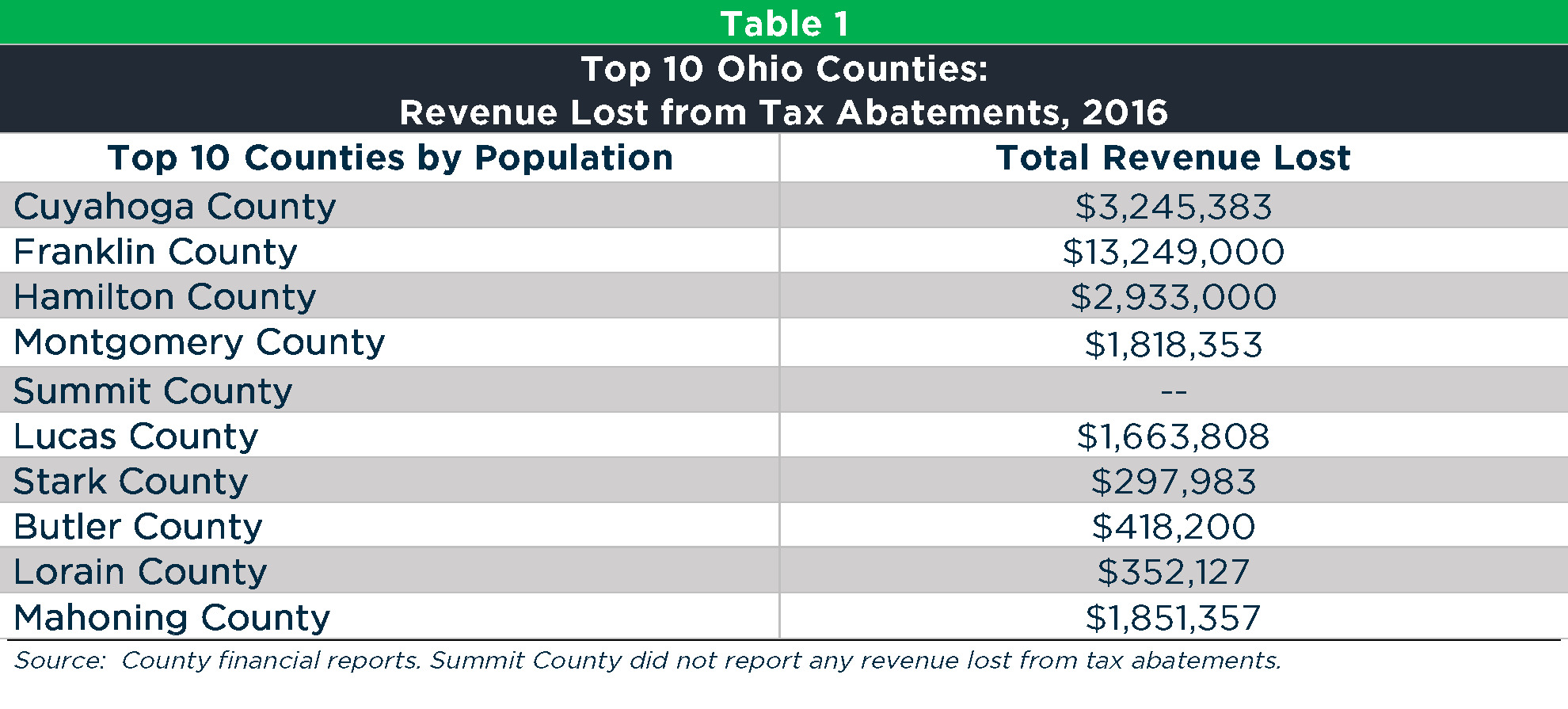

Local Tax Abatement In Ohio A Flash Of Transparency

Small Business Recovery Grant Small Business Development Center