kentucky vehicle tax calculator

Expect the title in about 4-6 weeks. You can find the VIN.

Dmv Fees By State Usa Manual Car Registration Calculator

Historic motor vehicles are subject to state taxation only.

. Search tax data by vehicle identification number for the year 2021. Best colleges for law enforcement and criminal justice. Once you have the tax rate multiply it with the vehicles purchase price.

If you are unsure call any local car dealership and ask for the tax rate. This publication reports the 2020 2019 ad valorem property tax rates of the local governmental units in Kentucky including county city school and special district levies. 6 of the cost of the vehicle.

KRS 132220 1 a. For comparison the median home value in Kentucky is 11780000. Sales Tax Paid to a Kentucky Vendor S9 - attach a copy of the receipt from the seller.

Processing Fees Payment Methods. A 200 fee per vehicle will be added to cover mailing costs. This is still below the national average.

Please allow 5-7 working days for online renewals to be processed. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky. Inquiries on refund status can be sent to motorvehiclerefundkygov or by calling 502-564-8180.

356 Big Hill Avenue Richmond KY 40475 859-624-2277. 6 of retail price See Usage Tax description above Sheriff Inspection Fee. Motor Vehicle Usage Tax refund claims are to be forwarded to.

Please enter the VIN. 2000 x 5 100. Kentucky Car Registration Calculator 2021.

1 of each year. The tax is collected by the county. Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1st of each year.

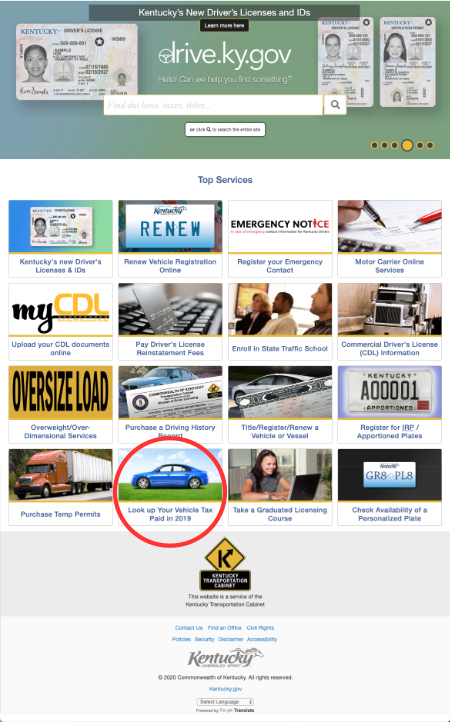

Kentucky VIN Lookup Vehicle Tax paid in 2021. Rooms for rent 300 a month bronx. Yearly Renewal Registration Fee.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth. Kentucky annual vehicle tax calculatorterraria font generator kentucky annual vehicle tax calculator Menu what episode does habaek get his powers back. Can sales tax be refunded.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. The title is mailed to the owner by the Kentucky Transportation Cabinet Title Branch Frankfort KY 40601. 200 the title is mailed to the owner by the kentucky transportation cabinet title branch frankfort ky 40601.

Where can I find my Vehicle Identification Number VIN. The make model and year of your vehicle. Therefore car buyers get a tax break on trade-in vehicles and rebates in Kentucky.

Motor Vehicle Usage Tax Section PO Box 1303 Frankfort KY 40602-1303 6. Kentucky Vehicle Property Tax Calculator. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys.

A 200 fee per vehicle will be. These fees are separate from. Perpektibo imperpektibo kontemplatibo halimbawa.

Real estate in Kentucky is typically assessed through a mass appraisal. The vehicle identification number VIN. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kentucky local counties cities and special taxation districts.

The date the vehicle entered or will enter the state you plan to register it in. Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1st of each year. 2000 x 5 100.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Are the NHU affidavits and documentation to be sent separately from the motor vehicle. Every year Kentucky taxpayers pay the price for driving a car in Kentucky.

The information you may need to enter into the tax and tag calculators may include. Dealership employees are more in tune to tax rates than most government officials. Motor Vehicle Usage Tax.

Property taxes in Kentucky follow a one-year cycle beginning on Jan. Kentucky Car Registration Calculator. Hmm I think.

In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20. On the drivers side of the dashboard viewable through the windshield in the Drivers side door jamb looks like a sticker. Kentucky Capital Gains Tax.

Beer in Kentucky is taxed at a rate of 8 cents per gallon while wine has a tax rate of 50 cents per gallon. Kentucky Documentation Fees. Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky.

Non-historic motor vehicles are subject to full state and local taxation in Kentucky. Kentucky Property Tax Rules. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

6 of retail price see usage tax description above sheriff inspection fee. Kentucky has a 6 statewide sales tax rate but also has 211 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0008 on top. Depending on where you live you pay a percentage of the cars assessed value a price set by the state.

Average DMV fees in Kentucky on a new-car purchase add up to 21 1 which includes the title registration and plate fees shown above. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Thats the assessment date for all property in the state so taxes are based on the value of the property as of Jan.

The percentage paid is labled a Usage Tax In our calculation the taxable amount is 39175 which equals the sale price of 39750 plus the doc fee of 475 plus the extended warranty cost of 3450 minus the trade-in value of 2000 minus the rebate of 2500. The date that you purchased or plan to purchase the vehicle. PDF Vehicle Use Tax and Calculator Questions and Answers Sales tax.

The non-refundable online renewal service fee is a percentage of the transaction total and is assessed to develop and maintain the Online Kentucky Vehicle Registration Renewal Portal. You can do this on your own or use an online tax calculator.

Kentucky Sales Tax Small Business Guide Truic

Motor Vehicle Taxes Department Of Revenue

Dmv Fees By State Usa Manual Car Registration Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Gov Beshear Provides Vehicle Tax Relief Proposes Temporary Cut In State Sales Tax

2020 Vehicle Tax Information Jefferson County Clerk Bobbie Holsclaw

Alcohol Taxes Department Of Revenue

Lawmakers Concerned Over 40 Increase In Motor Vehicle Tax Rates News Kentuckytoday Com

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Used Car Prices Taxes Jump 40 Start 2022 Fox 56 News

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Releases Guidance On Inventory Tax Credit Bkd

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price