free cash flow formula change in net working capital

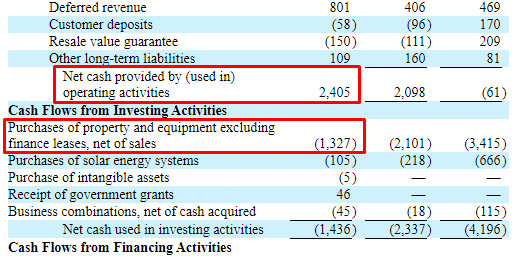

Changes in working capital -2223. Owner Earnings 8903 14577 5129 13312 2223 13084.

Fcff What Is Free Cash Flow To Firm

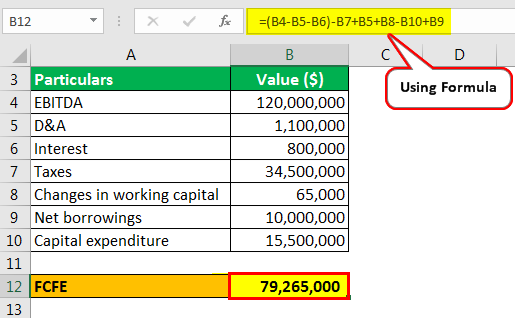

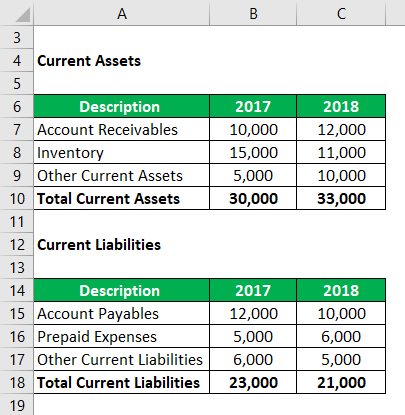

The last step is to determine the change in working capital by using the formula.

. Free Cash Flow is calculated by taking net income and adding back any non-cash expenses and subtracting capital expenditure and any changes in working capital in that year. Depreciation and Amortization DA Step 3 Subtract Capital Expenditures Capex Step. So the change in NWC is 135000.

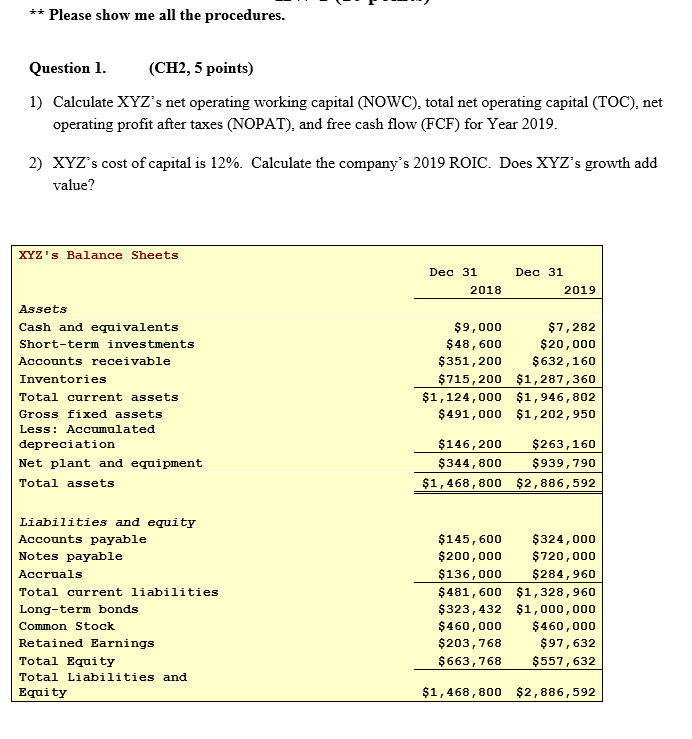

Ad Cash Flow Forecast Spreadsheet Templates for Business. Step 1 Calculate Net Operating Profit After Tax NOPAT Step 2 Adjust for Non-Cash Items eg. 240000 2022 105000 2021 135000.

Changes in net working capital show. Subtract the previous years working capital from the current years working capital according to the calculations made above in the table. For most companies you analyze by using the change in working capital in this way.

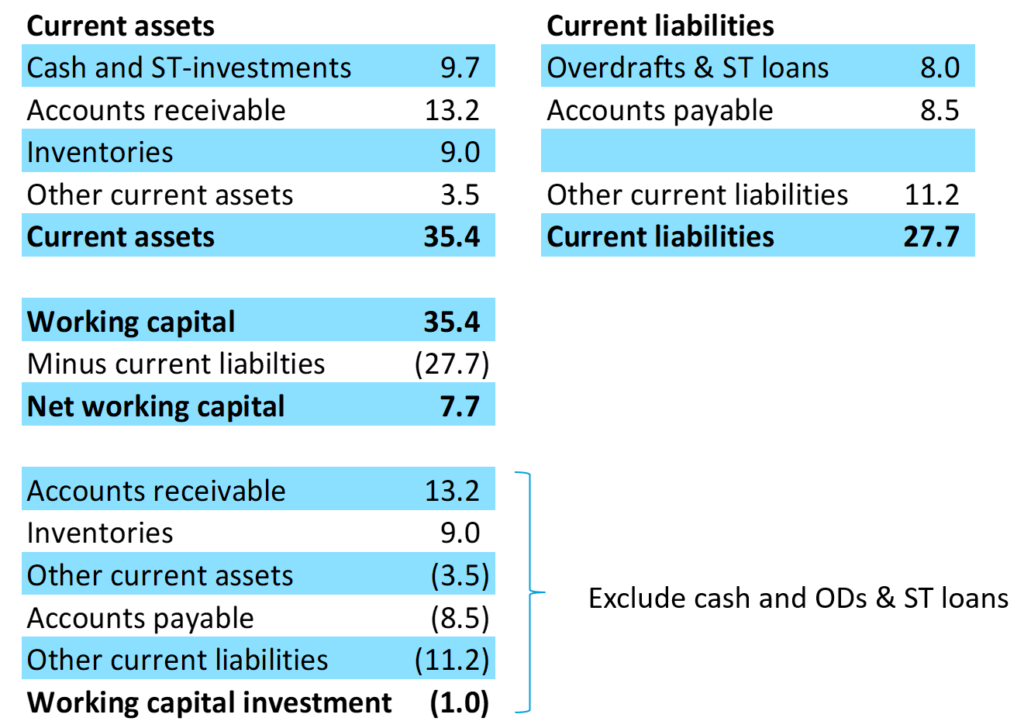

Changes in net working capital impact cash flow in financial modeling. So a positive change in net working capital is cash outflow. Cash Flow Templates for Excel Open Office Google Sheets More.

So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. The result is tax-effected EBIT also known as EBIAT or NOPAT. The first step in calculating FCF from EBIT is to net out estimated taxes.

On the cash flow statement the changes in NWC. A decrease in cash for example after purchasing a new property or equipment will decrease working capital. Similarly change in net working capital helps us to understand the cash flow position of the company.

This calculation involves multiplying EBIT by 1 t where t is the targets marginal tax rate. The net working capital ratio formula is 600000 of current assets divided the 350000 of current liabilities for a working capital ratio of 171. Conversely working capital will also rise when cash increases.

Since we have defined net working capital we can now explain the importance of understanding the changes in net working capital NWC. Components of FCF Formula- Adjustments from EBIT to FCF. Look closely at the image of the model below and you will see a line labeled Less Changes in Working Capital this is where the impact of increasesdecreases in accounts receivable inventory and accounts payable impact the unlevered free cash flow of a firm.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Solved All Answers Must Be Entered As A Formula 1 Calculate The Operating Cash Flow And Net Working Capital Calculating Total Cash Flows Excel 困 Home Insert Page

Free Cash Flow Fcf Definition Formula And How To Calculate Stock Analysis

Free Cash Flow Fcf In Financial Analysis Magnimetrics

What Is Free Cash Flow And Why Is It Important Example And Formula Article

Solved Calculate Xyz S Net Operating Working Capital Nowc Chegg Com

Change In Working Capital Video Tutorial W Excel Download

How To Prepare A Cash Flow Statement For A Startup Abstractops

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Warren Buffett S Secret Sauce And What We Can Learn From The Collapse By Jason Andrew Stark Naked Numbers Medium

Change In Net Working Capital Formula Calculator Excel Template

Underestimating Working Capital Investment

Change In Net Working Capital What Is Change In Nwc

Change In Net Working Capital What Is Change In Nwc

Differences Between Ebitda And Operating Cash Flow Meaden Moore

Changes In Net Working Capital All You Need To Know